Roger Colman 21 Feb 2024

I am going through the results but first impressions (all NZ dollars)

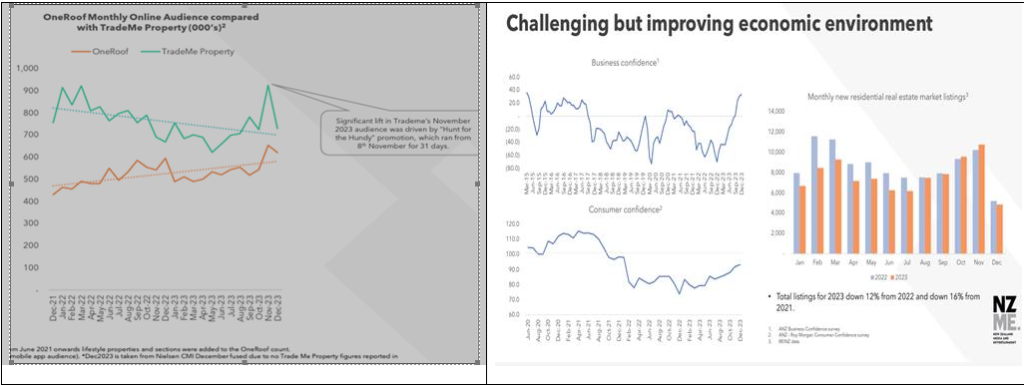

- One roof revenues up +80% Jan and Feb. Far above my +30% increase for CY24. NZME reckon cost and resources base is now higher than Trade Me and REINZ sites. State that the resources cost growth now flat at this new level. But I have increased cost/resources by 20% in CY24 in my model. Gap between ONE roof and Trade Me property now down to 119k UV’s pm. The ratio #2 to leader in NZ is now roughly 54/46 versus Zillow/Move: c75/25, REA/Domain: 78/22, and Rightmove 81/19. If One Roof keeps going closer and cross over to a 75/25 UV ratio would add up to $6.15 ps to 2030 valuation. ($70m at 15X EBITDA X). REA trades at a forecast 45X PER. NZME around One Roof lost $2m in CY23 , profitable in 2HCY23. So guess is NZME will reinvest all profits to try and get leadership. It’s too close not to have a bigger go. Note the graph below includes editorial traffic to One Roof, none for Trade Me exists, and higher rental traffic to Trade Me versus very small rental listing traffic and rental listings on One Roof. Trade Me rental/property viewers are mainly “break and enter” demos , (in OZ they would be Gumtree style traffic) and quality unique leads is currently the key One Roof revenue growth factor driving yield from seller listings. Adjacent graph is NZ sentiment indicator.

2. NZ economy may have turned with Nationals/Winston Peters/and ACT coalition being economically tight. Business confidence up. NZME says that Jan/Feb advertising was up on pcp but is against Cylone Gabrielle in pcp. But then further stated that March still looks better than pcp. Print /digital combinations may hold at around 13-15% EBITDA margin, but net revenues still to fall. Print publishing currently makes $23.8m EBITDA and digital, taking all journalists costs (100%) to digital, profits dropped in that digital publishing from $11.5m to $6.6m in CY23 on a digital advertising fall of 8%.

3. Radio Neutral : revenues down 4% on market down 6% . The same market fall as in Australia – minus 6%. As a high reach media the sector should be better through 2024.

4. Yet I am forecasting a slight uptick in CY24 EBITDA and EPS rising to around 9-10 cps and free cash flow another + 3cps making between 12-13 cps available. But I need to check reinvestment into working capital on a more pronounced recovery than forecast . NZ’s #1 economic activity is tourism and should recover strongly . e.g.: Air NZ reported yesterday was very high fare discounting into NZ from USA and Australia . You can fly Sydney to Auckland for around A$267 each way in March. SYD to PER is around A$300-330 each way.

5. Div: 6 cps final. No further capital management until peak debt is past around end of 2nd Qtr. CY24, as net debt/EBITDA is forecast to peak at 0.9X on a trailing 12 months EBITDA of c$40m. If EBITDA keeps recovering a little more , a very low possibility of a special div in 3rd qtr. CY24. But better addressed by a higher interim rather than the typical 3 cps interim/6 cps final. I make it 10 cps for the CY24 cash payment year (6 cps in March 2024 and 4 cps in say September 2024) with a 15% imputation credit for Australian holders. Not as good as 30% franked dividends available here .

6. Broker noise. Still under researched, and needs more open source research. But difficult to achieve given a A$170m market cap. At least it won’t go away. The New Zealand Herald has been published since 1863 and always made money in ASX history . Radio not going away as long as people are by themselves.

Numbers to follow before end of week.

Roger Colman

Pax Pasha Pty Ltd

23/72 St.Georges Cr.

Drummoyne , Sydney, 2047

Mobile: +61 (0) 414974666